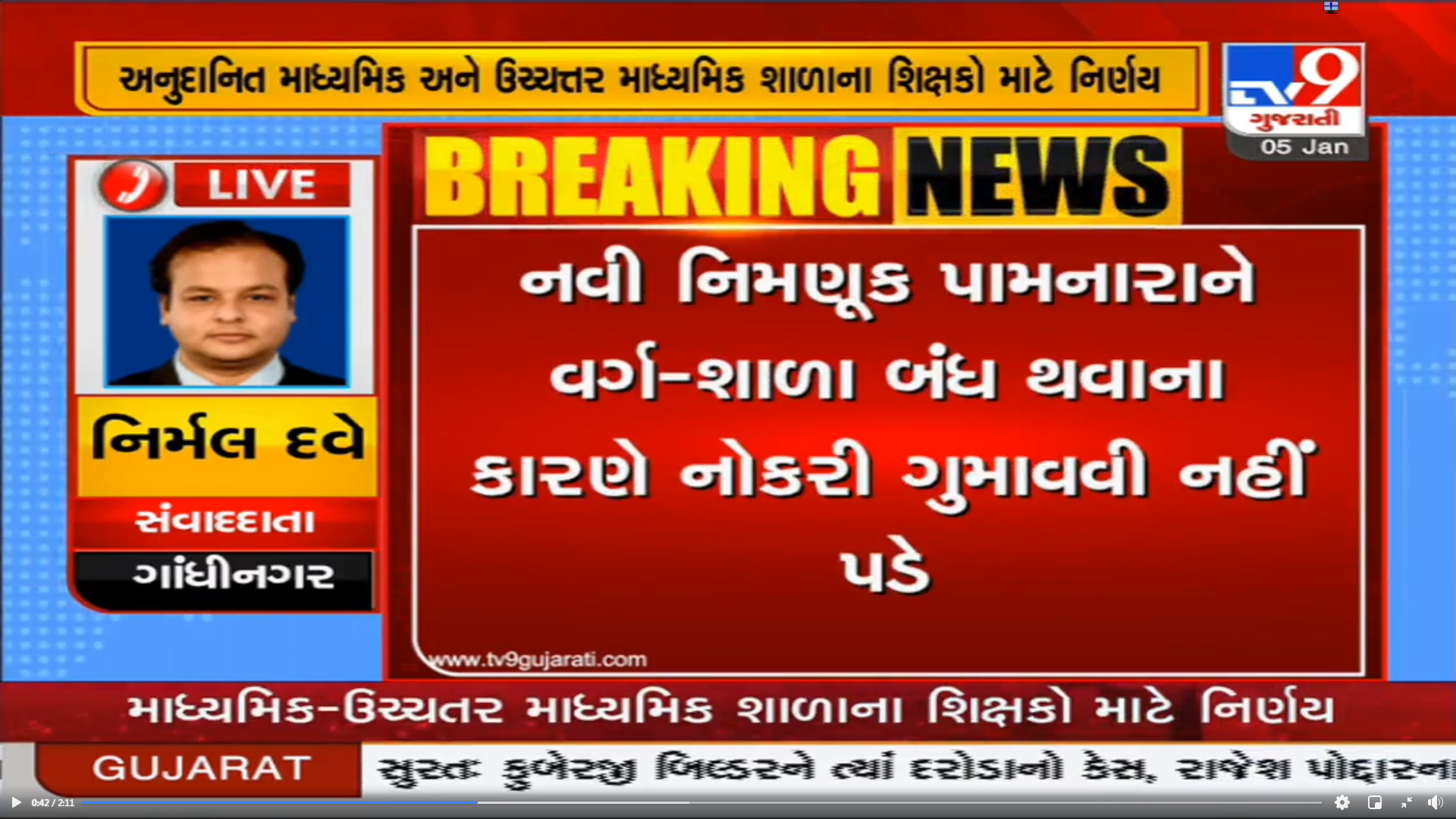

Rajya Sarkar No Mahatvano nirnay Granted school na Tamam Teachers ne Fajal Nu Rakshan.

when it comes o investment decisions ,it's better to leave it to the experts. a good investment advisor can help you maximise returns and minimise risks. so from the expert point of view, the best option for you as an investor to achieve your personal financial gols is mutual funds. here are seven advantages of mutual funds.

1.A Diversified Portfolio

=> Mutual fuunds invest in two main asset classes debt and equity. soome funds are pure debt, and some invest in just equity, other are balanced or hybrid.

=> The primary benefit of inveing in a mutual fund is that you get exposure to a variety of shares or fixed income instruments. fr instance if you wanted to invest rs. 1000 directl in stocks you would probably get only hare or two. if, on the other hand, you invested thrugh a mutual fund, you would get a baske of several stocks for the same amount.

=> If a few Securities in a portfolio don't perform , the others compensate. in this way , mutual funds ensure diversification. if you are a lay investor who doesn't want ot spend a lot of ime researching stocks , go for mutual funds.

2. There's a fund for everyone.

=> Ths could be one of the significant benefits of mutual funds. there are over 2,000 currently active schemes a lot to choose from you can find funds that match your risk appetite, inestment horizons and personal financial goals.

=> debt funds are that least risky, balanced or hybrid funds are moderately risky, and equity funds involve the highest rik. hower, the reward is directly proportional to risk . higher therisk.highr the returns.

even within these board categories, there are many choices. for example, a large cap equity fund will be less olatile and offer lower but stable returns. Mid - cap or small cap equity funds, on the other hand, can fluctuate widly but have the potential to give higher returns in the longer term. and when it comes to debt funds, a fund that invests in corporate paper will offer higher returns than a gift fund but will carry higher risk.

3. Benefit from high Liquidity

=> If you invest in open ended mutual funds , you can buy and sell your units at any time. your ttal redeemable or buyable value is based on the fund's net asst alue for that day.

=> close ended funds too can be liquid. even though they are for a fixed duration, close ended fuunds are listed on an exchange after the new fund offer closes. once these funds are listed on a stock exchange , they are frely bought and sold.

Digibank offers mutual funds that are instant, paperl

Tag :

news

0 Komentar untuk "Rajya Sarkar no Mahatvan Nirnay Granted School na Tamam Teachers ne Fajal Nu Rakshan"